Odds of a Financial Crisis Still High

There’s a significant amount of complacency in the financial world these days. Over the past few quarters, whenever there have been questions about the possibility of a financial crisis, we’ve often heard, “This is nothing like 2008–2009.”

Here’s the thing: all the stars have been lining up for some serious economic problems. One step in the wrong direction could lead to a financial crisis, and it could all happen very quickly.

Here’s what you need to know.

Financial crises happen at a time of stress in the financial markets. Some key indicators say there isn’t much stress in the financial system right now, but others hint that this could change.

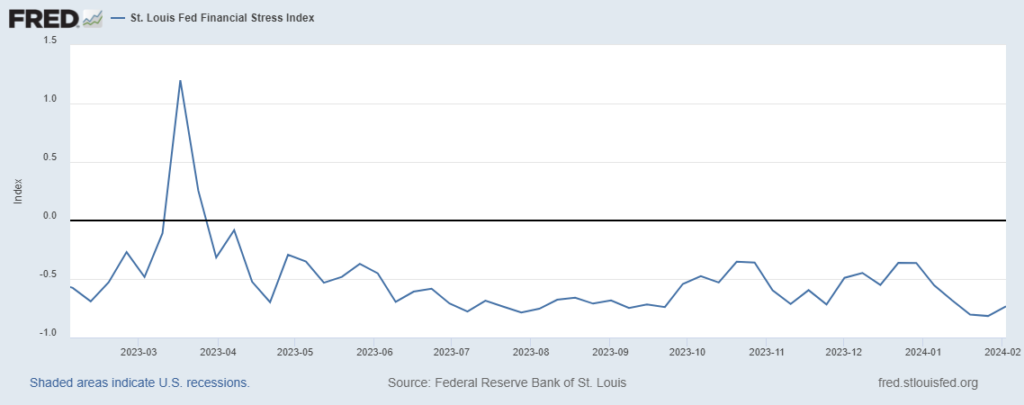

Take a look at the chart below. It plots the St. Louis Fed Financial Stress Index (STLFSI). This index, which measures the degree of financial stress in the markets, uses 18 weekly data series involving several interest rates, yield spreads, and other indicators.

How do you read this index?

A rating of zero means normal financial market conditions, a rating below zero means below-average financial market stress, and a rating above zero means above-average financial market stress.

(Source: “St. Louis Fed Financial Stress Index,” Federal Reserve Bank of St. Louis, last accessed February 14, 2024.)

The STLFSI is currently in negative territory, suggesting there isn’t much to be worried about, but there are some other risks lingering that might not be getting enough attention.

Regional Banks Remain in Dangerous Territory

Investors should keep a close watch on regional banks in the U.S.

In early 2023, there were a few bank failures. The U.S. government, the Federal Reserve, and some big banks were quick to come in and make sure the losses wouldn’t get bigger and become a systemwide problem.

It’s important to know, however, that U.S. regional banks aren’t out of the danger zone just yet.

When interest rates were near zero for some time prior to the recent hikes, regional banks doubled down on commercial real estate, and there are some serious troubles brewing in that market. This leaves U.S. regional banks exposed to risks of losing immense amounts of money.

So, who’s to say there won’t be more regional bank failures? You also have to wonder, could more regional bank failures create problems at the bigger banks and ultimately lead to a financial crisis?

It’s possible.

Interest-Rate-Backed Derivatives Could Trigger a Financial Crisis

It’s also important to look at what’s been happening with interest rates.

The Federal Reserve has raised interest rates quite a bit since 2022 in order to fight inflation. In late 2023, there were hopes that rate cuts could be coming in early 2024. This, however, might not happen as early as previously expected, since inflation in the U.S. continues to remain above the Fed’s target rate.

The uncertainty around interest rates is actually very dangerous. Why? It could affect how the derivative world reacts.

Keep in mind that derivatives are essentially weapons of mass financial destruction. If they go in a bad direction, it could lead to several bank failures.

Consider this: as of the third quarter of 2023, in the U.S. alone, commercial banks had derivatives backed by interest rates with a notional value of $147.77 trillion. (Source: “Quarterly Report on Bank Trading and Derivatives Activities: Third Quarter 2023,” Office of the Comptroller of the Currency, last accessed February 14, 2024.)

Now, imagine what will happen if just a small percentage of these derivatives go in the wrong direction as volatile interest rates and economic uncertainty remain. A small percentage of derivatives going bad could create significant counterparty risk in the financial system and bring us to the cusp of a financial crisis.

What to Expect When a Financial Crisis Happens

Dear reader, let me be very clear: I’m not rooting for a financial crisis. All I’m trying to say is to not get too complacent.

In my opinion, the odds of a financial crisis are now higher than they’ve been in more than a decade. I say this after looking at the risks that are underneath the surface and not being discussed.

If a financial crisis does become a reality, it won’t be a pretty sight. You could expect severe losses across the board. You could see the stock market tumble, currencies fluctuate wildly, home prices get volatile, and so on and so forth.

Remember, when a financial crisis happens, the value of everything becomes questionable. So, investors tend to run for the exits. In times of crisis, they want to hold cash and nothing else until investing conditions become somewhat more predictable.